Top of mind for many employees on the back of predicted high inflation for March 2024, is the ongoing gap between average base salary increases and the level of inflation post the Covid-19 pandemic. This raises concerns about the erosion of purchasing power of employees.

March 2024 Salary Survey Results

Viewed in isolation MHR Global’s March 2024 pay survey results appear to confirm that there is reason for concern. With average increases of 4.4% for both Top Executives and General Staff employees lagging forecast CPI movement of 4.7% for March 2024, employees are falling behind in the short term. To understand the implications of this however, we need to look at a wider range of factors, rather than merely reacting to the perceived inequities of the immediate situation.

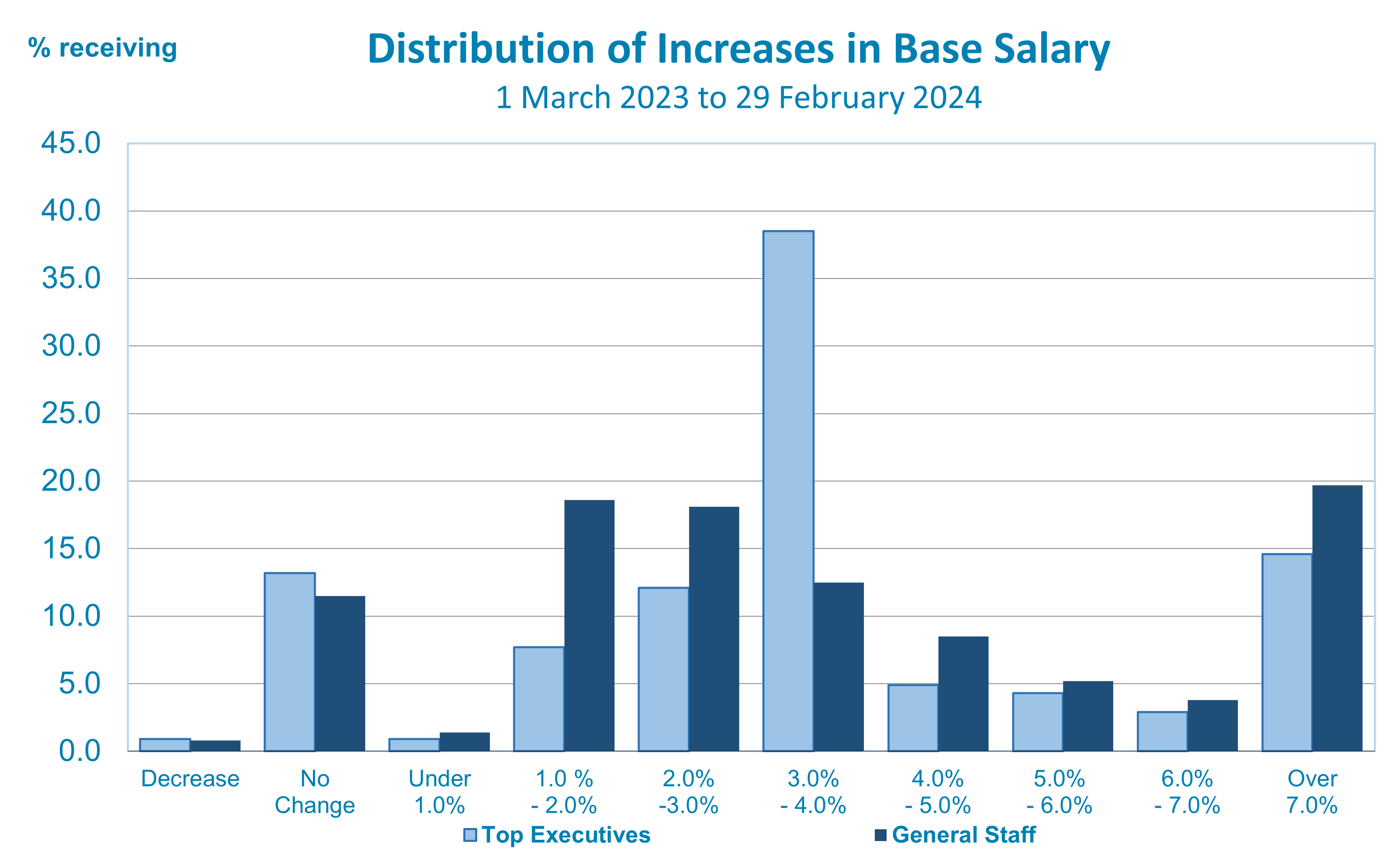

Firstly, we all need to recognise that the Base Salary Movement figures are averages calculated from the individual movements received by all staff who qualify for increases. To get a clearer picture of how individuals are being rewarded, consider the distribution of those increases. MHR’s March 2024 results are revealing. At Top Executive level, 21.8 percent of executives received increases of more than 5.0 percent. For General Staff the figure was 28.7 percent. Clearly, a significant proportion of both groups received increases which exceed inflation – which does not fit with the common narrative.

Naturally this is balanced by other staff who received increases below 4.0 percent – or no increase at all. It is safe to assume however, that not all staff perform at the same level, and that the higher increases have been received – in most cases – by those assessed as higher performing employees. If that argument is accepted, then an average increase which is less than half a percentage point behind the forecast inflation of 4.7 percent may be acceptable in the short term, while the Reserve Bank pursues strategies to regain control of inflation.

Longer Term Trends

Secondly, I would argue that the current issue being faced by both Employees and Employers, is not “low” pay increases per se, but the high CPI movement triggered by both the global pandemic and recent global inflation – both of which are outside New Zealand’s influence.

If we look at the comparisons between inflation (using CPI) and Average Base Salary movement over an extended period (from March 2015), a more informative picture emerges:

- From March 2015 to March 2021 Average Base Salary Movements consistently exceeded CPI movements – often by significant margins.

- Admittedly, over this period inflation was successfully constrained within the Reserve Bank’s target range.

- In March 2022 inflation increased substantially, to 7.2 percent, and has remained high until this year

- Note however that CPI has been steadily falling since that high of 2022

- Significantly, over this period Average Base Salary Movements have been higher than those recorded prior to March 2022.

Over the full period, Average Base Salary movement for Top Executives have exceeded the level of inflation (measured by CPI) by an aggregate of 8.7 percentage points, even allowing for the lag over recent years. For General Staff the comparison is even more favourable, at 9.1 percentage points.

This illustrates that if Employers and Employees focus only on the immediate problem of high inflation and (perceived) low pay increases, while ignoring the wider considerations, we run the risk of apparently fixing the immediate problem, while inadvertently creating a longer-term challenge – to maintain high levels of increases in the face of lower inflation and ongoing expectations of Employees.

Looking to the Future

The Reserve Bank has a stated intention of reducing the high inflation rate, back to the target range of 1.0 to 3.0 percent. Current Government policies also have the aim of reducing Public Sector costs by 6.5 to 7.5 percent overall. It is already clear that the latter will result in staffing cuts – largely to “back-room” roles. The need to reduce costs will also put pressure on spending decisions in both the Public Sector and in those businesses providing services to this sector. Both the Public and Commercial sectors will need to address this in deciding on the levels of pay movements.

That said, if both the Reserve Bank and the Government achieve their objectives over the medium term, and Employers can maintain current levels of pay movement, we will return to a scenario in which pay increases will once again exceed inflation. Given this, the current short term pain to achieve that more sustainable future may actually be worthwhile.